Content

The clear beneficiaries are those for which the difference between the net corporate rate and the pass-through rate was positive under old tax law and is negative under new tax law. This result is reflective of the ability of high income filers to defer income and the income limitations C Corporation Taxes on the 20 percent deduction. It may also reflect the fact that high income earners are more likely to have income from businesses that are disallowed from the 20 percent deduction. Most businesses taxed as C corps will file IRS Form 1120 for their corporate income taxes.

- Minutes must be maintained to display transparency in business operations.

- Shareholders must pay taxes on their share of income, even if the money is retained in the business.

- On the other hand, there’s only one tax return that combines personal and business assets or liabilities together with pass-through entities.

- Once formed, a corporation has a life of its own, with its own rights, capabilities, responsibilities, and liabilities.

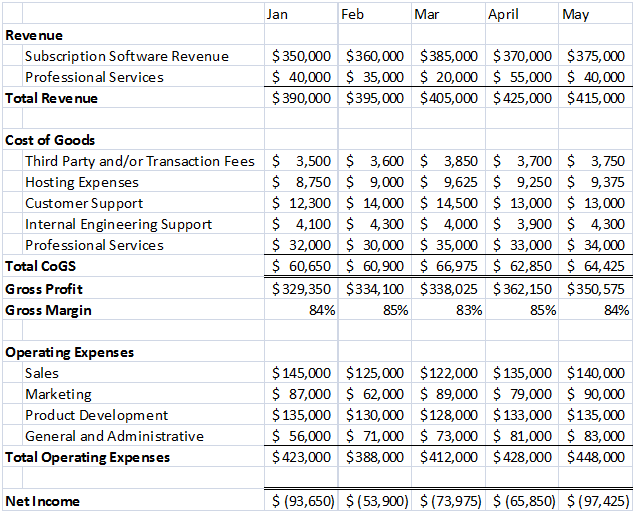

- If you are a C corporation, use the information in the chart below to help you determine some of the forms you may be required to file.

Lastly, file Form SS-4 to secure your employer identification number from the Internal Revenue Service , along with any other ID numbers based on your state’s requirements. When it comes to corporate ownership, c corps have no restriction on ownership, which goes back to our point about them having unlimited growth potential. But s corps don’t have that luxury as they’re restricted to no more than 100 shareholders. Also, s corps cannot be owned by a c corp, other s corps, LLCs, partnerships, or many trusts. But a c corp has no limits on who or what can be a shareholder.

What are some examples of C corporations?

The offers that appear in this table are from partnerships from which Investopedia receives compensation. This compensation may impact how and where listings appear. Investopedia does not include all offers available in the marketplace. This CT Corporation article familiarizes transactional attorneys and paralegals with key bankruptcy concepts that may arise in dealings with clients who find themselves creditors in a bankruptcy case.

However, it is required to register with the Securities and Exchange Commission upon reaching specific thresholds. The CT Corporation staff is comprised of experts, offering global, regional, and local expertise https://quick-bookkeeping.net/ on registered agent, incorporation, and legal entity compliance. Keep in mind that it is always wise to consult with tax professionals and legal professionals during any business formation process.

Learn About C Corporations

Further, the business must have company bylaws on the premises of the primary business location. C corporations will file annual reports, financial disclosure reports, and financial statements. Because a corporation exists separately from its shareholders, it has what’s called a perpetual existence. For example, if the owner of a sole proprietorship dies, the business ceases to exist. This isn’t the case with a corporation., Once a corporation is formed, it continues to exist until it is dissolved, wound up and liquidated, unless its articles of incorporation provide otherwise.

Unlike an S Corporation or an LLC, it pays taxes at the corporate level. This means it is subject to the disadvantage of double taxation. As well, a C corp also must comply with many more federal and state requirements than an LLC. The TCJA changed both the corporate and individual rates, so that there is now little difference between the tax rates paid on C-corporate and pass-through business income. For example, Table 1 shows that in 2017, C-corporate income faced a top tax rate that was 7.1 percentage points higher than the top tax rate faced by pass-through business income.